The top 10 best-selling diabetes drugs of 2013

The top 10 best-selling diabetes drugs of 2013

What is perhaps becoming a bigger deal for Big Pharma, however, is that with so many treatment options, and more coming, the market has gotten crowded and doctors and patients a bit confused. That has led to some studies to sort out which drugs work the best, and that in turn has led some researchers to suggest that for all of the extra money U.S. patients are paying for new treatments, little benefit is being seen. A Yale study, recently cited by Bloomberg, says that many patients have made the switch to analogs and are now spending much more on them than older drugs. But it found little change in the number of episodes of low blood sugar at night, one of the conditions doctors most want to control.

Dr. Silvio E. Inzucchi, director of the Yale Diabetes Center, speaking to The New York Times, asked rhetorically whether patients are any better off with all of the new drugs, then answered his own question this way: “You can control glucose with generics for $4 a month or some new ones that are $8 or $9 per pill. Some medicines are 100 times more expensive, but they’re certainly not 100 times as effective. In fact, they’re probably equal for most people.”

On this list of the best sellers, you will find a mix of the old and new. According to data from EvaluatePharma, one of the big dogs of big pharma data, these top 10 drugs had more than $28 billion in sales last year. All of them, even number 10, were blockbusters. King Lantus alone turned in $7.6 billion in revenue, more than the next two drugs combined and still selling strong. Revenues grew about 20% each of the last two years. Sanofi ($SNY) has been able to be aggressive with its pricing, particularly with the FDA decision to delay approval of potential rival Tresiba pending more safety data.

Read Full Article: http://www.fiercepharma.com/special-reports/the-top-10-best-selling-diabetes-drugs-2013?utm_campaign=AddThis&utm_medium=AddThis&utm_source=email#.U9pF8KWsbg8.gmail

NCPA Supports H.R. 4577 to Benefit Seniors; Rejects Misleading PBM Attacks

NCPA Supports H.R. 4577 to Benefit Seniors; Rejects Misleading PBM Attacks

Alexandria, Va. July 22, 2014 – National Community Pharmacists Association (NCPA) CEO B. Douglas Hoey, RPh, MBA issued the following statement disputing a cost estimate released today by representatives of the pharmacy benefit manager (PBM) industry regarding H.R. 4577, The Ensuring Seniors Access to Local Pharmacies Act:

“This study reflects that PBMs are getting desperate to continue denying convenient access to medication and pharmacy choice for Medicare seniors in medically underserved areas.

“The Centers for Medicare and Medicaid Services (CMS) has heard all of the PBMs’ arguments previously yet continues to reject them and instead expresses continued, strong support for the kind of patient choice protections that are embodied in H.R. 4577. CMS has disputed PBM cost-saving claims of ‘preferred’ network plans as currently structured. CMS has testified to Congress that, ‘some plans with preferred pharmacy networks do not appear to result in savings—instead of passing along savings achieved through economies of scale, these Part D plans instead charge the Part D program higher prices, increasing taxpayer costs.’ In that same testimony, CMS added that ‘expanding access to lower priced drugs’—as H.R. 4577 would do—’also has the potential to reduce government expenditures on Part D.’

Read full article here: http://www.ncpanet.org/newsroom/news-releases/2014/07/22/ncpa-supports-h.r.-4577-to-benefit-seniors-rejects-misleading-pbm-attacks

EMRs and ePrescribing: More Than “Ready” for Pharma

EMRs and ePrescribing: More Than “Ready” for Pharma

Feature Articles by Mark Heinold on June 16th, 2014

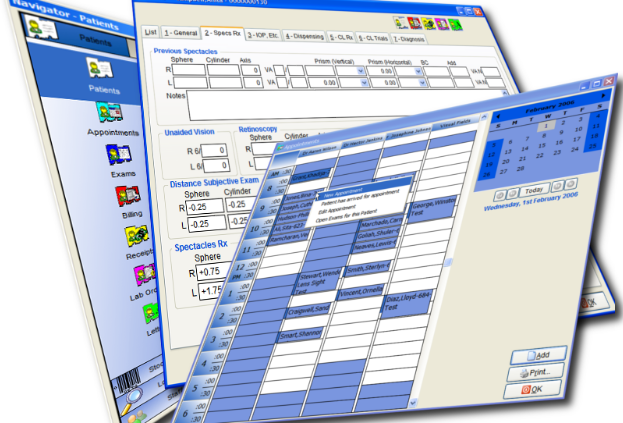

Few facets of medicine and healthcare have experienced the rapid growth witnessed in Electronic Medical/Health Records (EMRs/EHRs) and ePrescribing over the past five years. Yet we regularly hear pundits speaking about whether EMRs are “ready” for pharma, and whether physicians and other providers will allow pharma to “play” in this space.

We’re happy to see the topic gaining so much press, but admit to being baffled by the debate about whether EMRs are “ready” for pharma. The evidence clearly supports EMRs as both a well-established method for engaging prescribers and patients and a significant growth opportunity.

The editors at PM360 also hear the ongoing chatter about EMRs and asked me to expand my regular column to provide an update on the current state of the industry as it relates to pharma, and more specifically to the pharma marketer.

How Important Is Interoperability?

We suspect we’ll be hearing the debate about whether to say “EMR or EHR” long after this issue hits print, but industry consensus is that it’s a medical record if it works just within the confines of a single provider’s office. Conversely, the system becomes a health record when information can readily be shared and understood between providers (called “interoperability”) and from provider to patient.

So does it matter which system a prescriber is using? If you are a patient that wants to have your information travel easily from a primary care provider to a specialist and from the office to the hospital and back, this distinction certainly matters. But for pharma marketers seeking to engage the prescriber and patient at the point of care, the distinction between the two types of systems—and whether or not different systems can easily talk to each other—is of much less importance.

Practically speaking, the ability to deliver messages to either the provider or patient does not depend on the level of interoperability a system possesses. So while we are happy that the industry is moving toward an improved ability to share information across practice settings, because that improves patient care and the knowledge a provider has at their disposal, this is not a distinction that matters to the pharma brand leader seeking to engage patients and providers.

We support interoperability because it is good for patients, providers and the healthcare system as a whole, but we advise our clients not to be concerned with this when considering whether or not to be active in the channel. They are separate issues, and we assure you that pharma can be very engaged with patients and providers long before EMR systems can engage each other.

eRx Reach And Growth in Scale

The 2013 edition of the National Progress Report and Safe-Rx Rankings, published by Surescripts, the nation’s largest network for ePrescribing, came to press just as we finished this article (Figure 1). We were happy to see that our past predictions of continued growth and scale were well supported by this most recent data. According to Surescripts:

- 73% of office-based physicians are now ePrescribers, up from 69% in 2012.

- 58% of eligible prescriptions are now routed electronically, with electronically routed Rxs now topping one billion for the first time in history. This represents a 32% increase in prescription volume compared to 2012, almost double the volume from 2011.

- Primary care, endocrinology and physicians treating cardiovascular disease have the highest rates of ePrescribing, with 80% or more of these physicians now engaged in ePrescribing on a regular basis.

- Routing of prescriptions to mail order pharmacies increased significantly in 2013, with a 31% increase in prescriptions to this channel. In fact, mail order prescriptions sent via EMR have grown from fewer than four million just five years ago to more than 63 million last year.

- 95% of all pharmacies are now capable of receiving ePrescriptions, and acceptance at chain pharmacies is almost universal, with 98% capable of accepting an eRx (the common abbreviation).

Big Pharma’s Favorite Prescription: Higher Prices

Big Pharma’s Favorite Prescription: Higher Prices

Earl Harford, a retired professor who lives in Tucson, recently bought a month’s worth of the pills he needs to keep his leukemia at bay. The cost: $7,676, three times more than when he began taking the pills in 2001. Over the years he’s paid more than $140,000 of his retirement savings to cover his share of the drug’s price. “People with this condition are being taken advantage of by the pharmaceutical industry,” says Harford. “They haven’t improved the drug; they haven’t done anything but keep manufacturing it. How do they justify it?”

As evidenced by Pfizer’s (PFE) proposed $100 billion-plus takeover of AstraZeneca (AZN), Big Pharma is in the throes of the greatest period of consolidation in a decade. One reality remains unchanged, however: Drug prices keep defying the law of gravity. Since October 2007 the cost of brand-name medicines has soared, with prices doubling for dozens of established drugs that target everything from multiple sclerosis to cancer, blood pressure, and even erectile dysfunction, according to an analysis conducted for Bloomberg. While the consumer price index rose just 12 percent during the period, one diabetes drug quadrupled in price and another rose 160 percent, according to an analysis by DRX, a provider of comparison and management software for health plans.

Read Full Article: http://www.businessweek.com/articles/2014-05-08/why-prescription-drug-prices-keep-rising-higher#rshare=email_article

CMS issues final regulations for Medicare Advantage and prescription drug benefit (Part D) programs

CMS issues final regulations for Medicare Advantage and prescription drug benefit (Part D) programs

Drugstorenews.com: May 20, 2014 | By Michael Johnsen

BALTIMORE — The Centers for Medicare and Medicaid Services on Monday issued final regulations for the Medicare Advantage and prescription drug benefit (Part D) programs. The final rule is projected to save an estimated $1.6 billion over the next 10 years, the agency reported.

“The policies finalized in this regulation will strengthen Medicare by providing better protections and improving health care quality for beneficiaries participating in Medicare health and drug plans,” stated Marilyn Tavenner, CMS administrator. “The final rule will give CMS new and enhanced tools in combating fraud and abuse in the Medicare Part D program so that we can continue to protect beneficiaries and taxpayers.”

Read full article here: http://drugstorenews.com/article/cms-issues-final-regulations-medicare-advantage-and-prescription-drug-benefit-part-d-program

NACDS supports Senate letter to HHS urging more time to implement Medicaid reimbursement

NACDS supports Senate letter to HHS urging more time to implement Medicaid reimbursement

Drugstorenews.com – May 21, 2014 | By Antoinette Alexander

ARLINGTON, Va. — Citing the need for a one-year transition period for states to implement the July average manufacturer price-based federal upper limits, or FULs, nine Senators are urging Department of Health and Human Services Secretary Kathleen Sebelius to consider the challenges that states will face when the final Medicaid AMP-based FULs are published. The National Association of Chain Drug Stores has expressed its support for sending the letter.

In July, CMS will publish the final Medicaid AMP-based FULs. The agency has indicated that it expects the new FULs to be effective immediately.

Read full article here: http://www.drugstorenews.com/article/nacds-supports-senate-letter-hhs-urging-more-time-implement-medicaid-reimbursement?utm_source=MagnetMail&utm_medium=email&[email protected]&utm_content=DSN-NLE-DSNam-05-22-14